United States. While some auto imports are protected by deals, others face tariffs that could reshape the industry in North America.

In recent months, President Donald Trump has reactivated his trade agenda with the implementation of a series of tariffs that impact various industries, including automotive. Although the approach has been confusing and changing, the auto parts sector remains at the center of the discussion, especially because of its key role in North American supply chains.

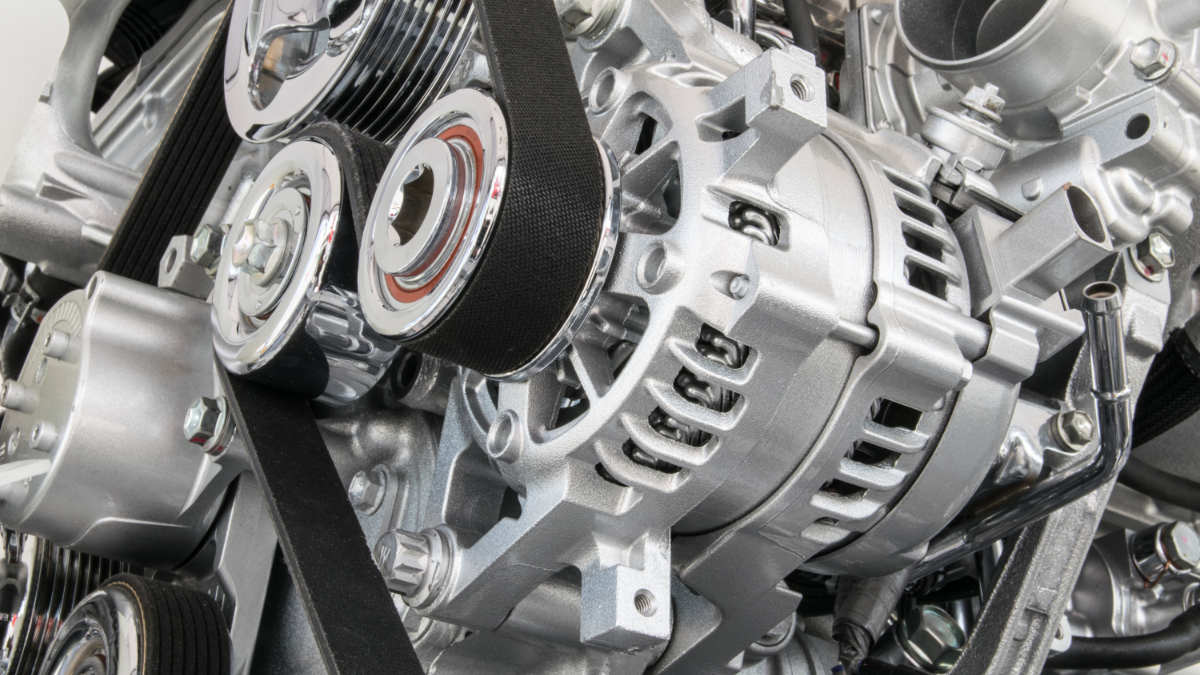

Since May 3, a 25% tariff on cars and auto parts came into force, with some exceptions, which mainly affects products imported from countries that are not part of the United States-Mexico-Canada Agreement (USMCA). This agreement, signed in 2018, has served as a shield for a large part of regional trade, since auto parts from Mexico and Canada have been exempt from tariffs since April 2.

However, not all assets are protected. Auto parts that do not fall within the USMCA clauses face an additional 25% tariff from March 4, which could increase costs for manufacturers and suppliers in the region.

In addition, a universal tariff of 10% on imported goods has been in force since April 5, and although it is not detailed if it applies directly to the automotive sector, its effect could extend to essential components used in the industry.

China, meanwhile, faces a 30% tariff on several product categories, although some electronics – such as smartphones and computers – have been exempted since April 12. The good news for the automotive industry is that these products include modules and sensors that are used in new-generation vehicles, partially relieving pressure on manufacturers.

As for the future, uncertainty persists. Trump has threatened new tariffs on products such as semiconductors and copper, two fundamental inputs for the manufacture of electric cars and advanced technological systems. Any move in that direction could further complicate the operation of automakers and suppliers in the U.S.

An uncertain scenario

Although some of the most aggressive tariffs have been paused – such as the so-called "reciprocal" tariffs or the increase to 145% on Chinese goods – the discourse of trade confrontation is still in force. For analysts, this forces automotive companies to strengthen their risk mitigation strategies, such as diversifying suppliers or relocating part of their production.

In a global context marked by the energy transition, automation, and the pressure to maintain efficient supply chains, the tariff factor becomes a critical variable that could redefine North America's competitiveness in the automotive industry.