United States. The Specialty Equipment Market Association (SEMA) presented its most recent 2025 Market Report, in which it reveals important consumer trends that are shaping the automotive aftermarket and accessories industry, as well as the automotive sector in general.

The analysis points to a sustained, albeit more subdued, growth environment, with clear opportunities for manufacturers, distributors, and specialty market enthusiasts.

During 2024, consumers in the United States spent more than 52,650 million dollars on vehicle customization and modification. The report, available to media upon request, provides a detailed breakdown by vehicle type and product category.

- Market insights: between enthusiasm and moderation

After the boom experienced during the pandemic, SEMA anticipates a return to more stable annual growth rates, between 4% and 5%. Factors such as the aging of the vehicle fleet — which reached an average age of 8 years, according to S&P Global Mobility — and rising new car prices are driving owners to invest in upgrades, repairs and customization.

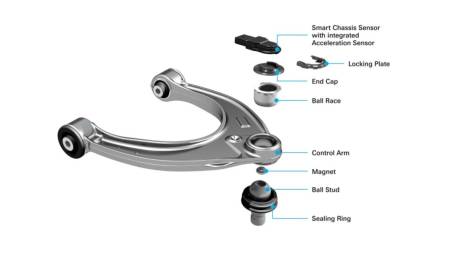

Sales remained stable or slightly higher in most product categories during 2024. The suspension, exhaust and engine control lines stood out, with growth of more than 2%, a trend that has been dragging on since 2021. By contrast, mobile electronics, such as GPS navigation and sound systems, fell due to the increasing inclusion of integrated technology in new vehicles.

In terms of vehicle type, pickups continue to dominate the market, while crossovers (CUVs) are consolidated as the fastest growing segment. In contrast, sedans, coupes and some sports cars continue to decline.

In addition, the consolidation of the hybrid shopping model – online and in-store – reflects a definitive change in aftermarket consumption habits.

- Pickups: the queens of customization

Pickups already account for a third of the total market for specialized equipment, leading most of the categories of modifications and accessories. "If there's one thing Americans love as much as their pickup trucks, it's modifying them to make them their own," said Gavin Knapp, SEMA's director of market research. "We found that pickup owners are at the forefront of improving the safety, performance and comfort of their vehicles, which is aligned with the heavy investment they already made when purchasing them."

- Electric vehicles: less sales, more adrenaline

The growth forecast for electric vehicles (EVs) has been adjusted. Whereas they were previously expected to account for more than a third of new sales by 2035, the estimate now stands at just 22%.

Despite the slowdown in sales, the data shows an increase in interest in performance among EV and hybrid owners, who lead the purchase of protective clothing and equipment for competitions. However, these vehicles barely represent 4% of the aftermarket, given their low share and the limitations to be modified. "EV owners traditionally have less ability to modify their vehicles, which translates into less market share," Knapp said. "That said, it's worth looking at how these vehicles are driving, as interest in performance is growing. Tuning and EV skills represent a new niche with great potential for the industry."

- 80s classics: new generation of icons

Vehicles model year 1989 or earlier officially fall into the "classic" category within SEMA's analysis, marking a generational shift in collectors' taste. Many of these cars, such as models from the 80s or 90s, are now the protagonists of exhibitions and parts coveted for their emotional value. "Collectors are drawn to vehicles they have an emotional connection to: a car from an iconic movie or a pickup truck driven by the popular kid in the neighborhood," said Christian Robinson, SEMA's senior director of state government affairs. "It's only natural that this group now includes models from the '80s. These will be the classics of the next generation: a DeLorean like the one in Back to the Future, or eventually a Supra from the 90s like the one in Fast and Furious. It is critical to provide a solid foundation to preserve and continue this country's rich automotive legacy."

See the full study at this link