Mexico. The National Auto Parts Industry (INA) reported that the U.S. government issued a new Executive Order to avoid the accumulation of tariffs on products originating in Mexico and Canada, including those in the auto parts, steel and aluminum sectors.

The measure was signed by President Donald Trump on April 29 and seeks to prevent the same product from facing multiple tariffs under different regulatory frameworks.

According to guidance published by Customs and Border Protection (CBP), it is confirmed that:

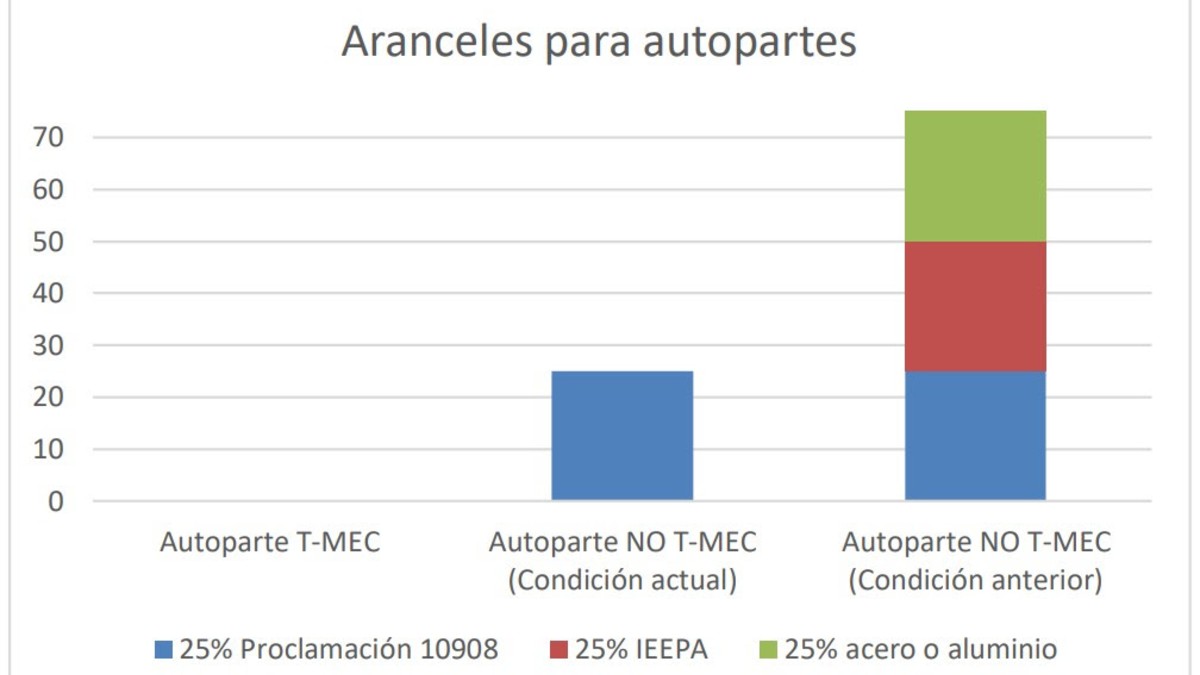

- Mexican auto parts included in Proclamation 10908 and that comply with the USMCA will be exempt from any tariffs.

- Even those that do not qualify under the USMCA will be free from additional tariffs imposed by the International Emergency Economic Powers Act (IEEPA) and Section 232 on steel and aluminum.

This means that a steel auto part outside of the USMCA, but included in Proclamation 10908, will no longer face a triple tariff burden. Only the tariff corresponding to the auto parts category will be applied, which reduces the tax burden for exporters.

However, there is one exception: auto parts not included in Proclamation 10908 and that combine steel and aluminum will be subject to two tariffs of 25%, not counting the IEEPA. An example is insulating tubes with mixed metal joints.

The changes will apply retroactively to imports made from March 4, 2025. Before May 16, the modifications to the U.S. tariff system (HTSUS) are expected to be published, along with the guidelines for requesting refunds.

Although the new tariffs were announced on April 3, their effective application begins on May 3 at 12:01 a.m. (U.S. Eastern Time). The decision seeks to avoid duplication of positions for the sector and preserve the competitiveness of the North American automotive chain.